Twitter Peek, Apple Newton, Google+, Amazon and Facebook phones are only some of a long list of misguided products and services that made it to the market only to crash and burn.

If you look at their makers, you’d hardly expect them to fail. Still they did. Apple Newton tried to do too much too soon. Google+ never had a clear vision, hence it ended up being nobody’s favorite social network. Twitter Peek wrongly anticipated that people would need yet another smartphone-sized device that could only do one thing. Facebook and Amazon tried to capitalize on their success, yet created low-end phone devices that couldn’t stand up to competitors.

So what do all these failed products/services have in common? Assumptions.

Building a product or a service based solely on assumptions eventually faces you with a harsh, double-sided reality: either the market is not ready for your product, as it was the case with Apple Newton; or customers don’t need or want your product.

So how do you know what the market is ready for? How do you know what customers want or need in a product? Design thinking delivers the answers from a human perspective. Read through to find out why and how we’re using it in all our digital projects – and you could too – to solve user problems worth solving and create products that customers love.

A guarded, rapid switch from guessing to knowing

Stanford University’s Hasso Plattner Institute of Design, better known as the d.school, pioneered design thinking as an efficient approach to product and service innovation. Often understood as “a lot of post-its, a lot of prototyping”, design thinking is actually a problem-solving tool which focuses on empathy, experimentation, and learning from mistakes.

Before going deeper into what design thinking entails, you should know that empathy and failure are two key concepts you’ll be constantly working with. If you’re not used to understanding the needs and motivations of the people for whom you’re designing a product, design thinking teaches you to really feel on their behalf. If you have a hard time letting go of a product idea, even when it’s dead wrong, design thinking helps you embrace experimentation and accept failure.

Let’s simplify. When you’re thinking about a new product or service, you’re not always sure about the problem you’re trying to solve or the ways to solve it. In most cases, you’re assuming both the problem and the solution. At the same time, you need to make sure you’re solving a problem worth-solving – otherwise, you’ll end up with an unwanted product such as Twitter Peek and the likes.

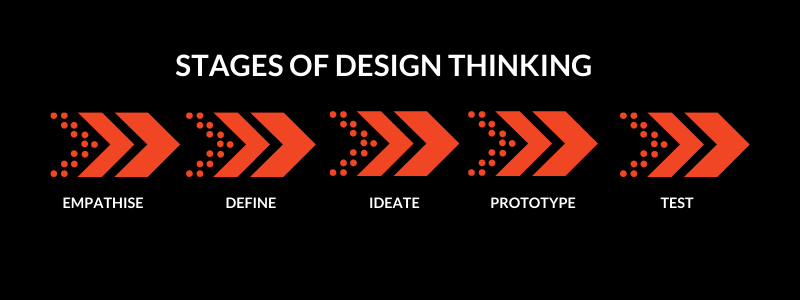

Design thinking helps you switch from “guessing” to “knowing”, frame the problem and solve it through 5 stages.

At each stage, you go back to the end-user and work collaboratively because that’s where your source of truth is:

- End-users will share the problems they’re facing, and most of the time you’ll find that they are a lot different than what you had in mind.

- They will validate your ideas, so you’ll no longer work with “what ifs”.

- Along the way, they will generate new insights, like a new feature or a new experience twist that you wouldn’t have thought of otherwise.

![[Smart Working] How Design Thinking Helps You Build Products That Customers Love](https://qualitance.com/wp-content/uploads/2020/07/design-thinking-@Q.jpg)

Design thinking in action @QUALITANCE

User feedback is the data that you will use to experiment quickly, do a prototype, test it and learn from it. Failure is merely a part of the experience because it allows you to regroup and try a different, hopefully better approach. The process rarely takes a linear approach. At any point, you can go back to different parts of the process to fine-tune your work before eventually moving forward.

How to use design thinking to turn banking services into hassle-free experiences

Generally companies prioritize business requirements such as profit, compliance constraints, legacy systems, regulations, etc. All these business-related aspects have little to do with what the end-user needs to get their job done. In most cases, requirements get in the way of helping the end-user.

The greatest part about design thinking is that it doesn’t let the business requirements dominate the user experience. On the contrary, it prioritizes what the users need so they can thrive, while creating a living proof that your product is market fit.

Suppose you want to create a hassle-free digital way for people to buy a house, like QUALITANCE did for BCR ERSTE customers. If you work collaboratively with the end-users – as design thinking prompts you to, you will accurately define the toughest problems in what makes one of the TOP 3 most stressful experiences of a lifetime.

We listened to BCR customers and found out that getting a mortgage loan makes them feel lost, hopeless, and tired because it’s paper-heavy, blurry and time-consuming. We also listened to what BCR employees had to say on what makes their work stressful, difficult and counterproductive.

With that in mind, we came up with several ideas on how to solve these problems for them, and explored them with real people. So, we set up a rapid prototyping workshop that allowed us to eliminate assumptions, think critically, and work with validated truths. For 48 hours, we worked together with bank employees and customers, tested hundreds of mortgage prototypes and had many AHA moments.

By the end of the workshop, we had achieved major breakthroughs in the user experience. From a mortgage simulator to a common document repository and a client-file tracking system, we validated a wide range of new digital bank experiences. For each of them, we created a straightforward, empathic customer experience with transparent and predictable flows.

The rapid prototyping workshop became the foundation of BCR Casa Mea – the digital platform that several months later already reduced bank visits by 60% and time to yes & cash by 50%, with 0 defects ever since. To discover how customers felt about the new digital mortgage experience we created, watch their reactions in the video below.

If you want to hone your skills in design thinking, you might want to subscribe to our BottomUp Skills free e-learning platform for busy innovators, makers and creatives. You can either listen to the 14-episode Design Thinking podcast or you can do the Digital Thinking Masterclass delivered by our CEO Mike Parsons. Either way, your access to these insightful bite-sized courses is free.