#BiPS — The Full Reserve Digital Currency

I probably need to give a little background as to why I believe the world needs a better way for finance to function and why money and the movement of money needs to be recalibrated as much as possible towards a full reserve economy.

“There is nothing more difficult to execute, nor more dubious of success, nor more dangerous to administer, than to introduce a new order of things; for he who introduces it has all those who profit from the old order as his enemies, and he has only lukewarm allies in all those who might profit from the new. This lukewarmness partly stems from fear of their adversaries,.. and partly from the scepticism of men, who do not truly believe in new things unless they have actually had personal experience of them.”

Machiavelli, The Prince, 1532

I am proud to be an FCA regulated individual, and I need to qualify that this article is my own personal view and not that of the company, colleagues or the shareholders in the organisations that I represent.

This is not a dig at the people who work at the current central banks or global financial giants that rule our financial world, more of a reflection and subject for debate and action. I need to give credit to our Ex Bank of England Governor Mervyn King, Joseph Huber and James Robertson with their “Creating new money” paper written in 2000 that have aided the formation of the BiPS Project and Foundation*.

A far-reaching possibility for the future was outlined by one of the Bank of England’s Deputy Governors, Mervyn King, in a speech last year (1999) at an international conference of central bankers. He suggested that electronic transactions in real time hold out the possibility that one day it will be possible for final settlements to be carried out by the private sector without the need for clearing through the central bank.*

It’s 10 years since the original company I founded, Prestbury Finance, in partnership with my friend collapsed. The company didn’t fail because of demand, service or supply — it failed because of a flawed financial banking system. The financial system failed because of fractional reserve banking.

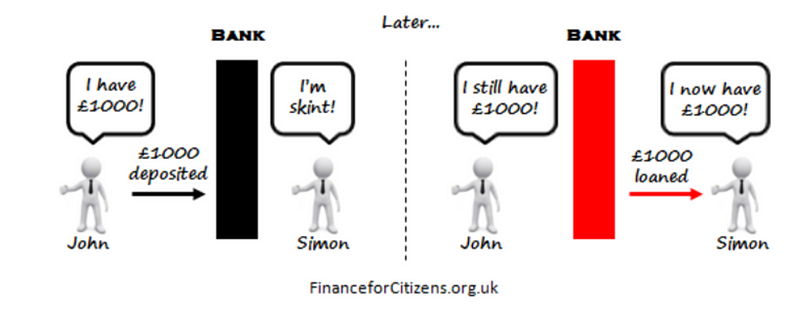

Take the image below; if the saver wants his money back and the bank hasn’t got it — then a run on the bank occurs and the banks need bailing out by the Governments and tax payers. A better type of banking would be full reserve banking, i.e. £1,000 deposited stays with the bank for stability and security. This is highly unlikely as the global economy is now completely built on debt; but we can certainly work on areas that can be improved, so if full reserve banking is near on impossible; what about a full reserve digital currency?

I founded the financial brokerage aged 21 in the early 90’s, and I embraced the opportunities the internet presented with broadband and grew the business at scale. I secured the underwriting to float the business on the London Stock Exchange AIM 2002 aged 29 years old with 100,000 + happy clients who we helped to buy their first homes and fulfill their financial dreams.

It all went wrong in 2008 as a result of wall street financial engineering and an old-boys network blagging to global pension funds and savers about the fantastic investment known as securitised debt. It’s still going on today and makes me sick to my stomach at the abuse of the average global saver, borrower and worker.

In the information age, money has mainly become information, electronically stored and transmitted. Monetary policies that serve the public interest can no longer be founded on a smoke-and-mirrors fiction that “real money” lurks behind the information.

An example of the information abuse came from a VC investor I met recently who bragged that he made £100 million from shorting the mortgage market in the run up and aftermath from the credit crunch and anyone who didn’t do the same with market knowledge was stupid; what a parasite; I personally believe shorting companies should be banned, what good does it serve?

Following the credit crunch in 2009 I had plenty of time on my hands to research to see if a better way for finance to function could ever become a possibility. I researched financial engineering and the history of money, and the undeniable truth became obvious very quickly. For the last 100 years the world has been controlled by a handful of global financial elitists for their own, and their shareholders and insiders personal gain. I know I stated that I supported capitalism, and I do, but the current system is just so god damned corrupt and protectionist it’s like the mob.

I committed to work towards a more equitable financial system, and avoid engaging with the bad actors whenever possible. With the global technological advancements there had to be a better way, I had seen how the debt free non central-bank digital currency MPeso in Nicaragua had helped boost their economy and financial security and a I came across the digital currency Bitcoin.

Satoshi Nakamoto created a new type of secure non-government controlled Peer to Peer electronic money and called it Bitcoin in 2009. I remember being sat at my desk buying Bitcoin in early 2011 and the time it took was so painful and complicated I gave up after a couple of purchases and disposed of the computer some time after — it was very much like the first time you tried to download a film or picture over dial up internet, the technology was not there to adopt efficient transfers of value, until today. Look at netflix now via your mobile phone!

The units of money in circulation represent economic value. Money can be related to any item subject to economic valuation (pricing) and transaction (exchange). Hence the dual economic function of money: as units of account, the units of money can serve for counting or measuring economic value; and, as means of payment, they can serve for carrying out transactions by transferring units of money in exchange for items bought. What is usually thought of as their third function — as a“store of value” — refers to the fact that they can be saved as means of payment for use at a later date.

The words above were written ten years before the creation of Bitcoin and the Blockchain project was born; many people believe digital Peer to Peer money was the brainchild of the Satoshi Nakamato who wrote the Peer to Peer electronic cash system post credit crunch. In fact the non government controlled electronic/digital currency movement was being discussed as soon as the internet was created by Tim Berners-Lee in 1983.

It was during the early days of Bitcoin that the realisation hit home to me that the digital Peer to Peer economy would be a major force of good for the the future, I formed eMoneyHub Ltd in 2012. Disruptive electronic Peer to Peer platforms were going to be the future and I wanted to be at the heart of it. Think of the growth in UBER — eBay — AirBNB; maybe even a non centralised global Peer to Peer currency for foreign exchange, business lending, mortgages maybe even to hold the currency privately as a secure store of value?

Creating new money paper written in 1999

Although this would need much greater computing power than is at present available, there is no conceptual reason to prevent two individuals settling a transaction by a transfer of wealth from one electronic account to another in real time. The assets transferred could be any financial assets for which market-clearing prices were available in real time. Financial assets and real goods and services would still have to be priced in terms of a unit of account. But a single process could simultaneously match demands and supplies of financial assets, determine prices and make settlements. (Basis Points AKA BiPS)

The cost to the state of issuing new money is only the cost of producing banknotes and coins. The cost to the banks of issuing new money is virtually zero. The state receives public revenues from issuing cash, but banks make private profits. The benefits of the money system are therefore being captured by the financial services industry rather than shared democratically

The loss of this privilege is equivalent to an extraordinary twelve pence on income tax in the UK. In effect it has become a subsidy to the private banking sector — a nice little earner, but one that should always have been for public benefit rather than private gain.

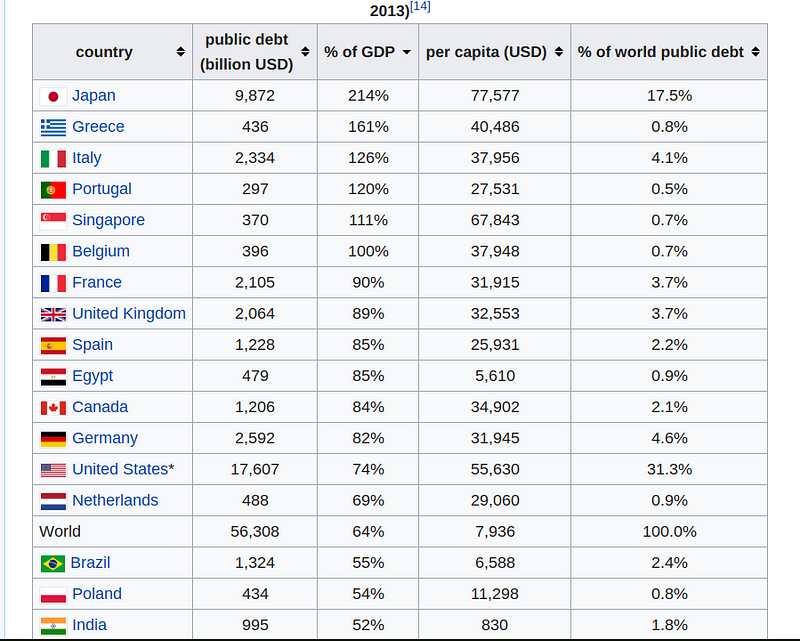

With the level of sovereign debt of nations below and their centrally issued currencies, a move to full reserve global banking is never going to happen. But a technological opportunity has now presented itself to power a full reserve, asset backed, debt free digital currency not backed by any Central Bank or Government. BiPS anyone?

I started my full reserve journey with the creation of our Peer to Peer platform in 2012; we had Zopa and Ratesetter in the UK — Lending Club and Prosper in the USA and the financial nevana of a full reserve Peer to Peer banking/financial model looked like a possibility. No debts or financial engineering — just savers lending to borrowers, only money that they had spare, no borrowing, hedging, leveraging simple 1–2–1.

The need to limit excessive money creation would be replaced by a concern to ensure the integrity of the computer systems used for settlement purposes, and the integrity of the unit of account. (Public Blockchain?)

A debt-free stock of money will be used by the public at home and abroad in just the same ways as they use money now.

I created our P2P savings and loan platform on the same transparent debt free co-operative principles, no investment trusts, hedge funds or NASA scientists financial engineering buckets of mortgages and loans.

At JustUs we are the only Peer to Peer mortgage and loan platform that’s owned by it’s real world shareholders; no VC’s or preferential shareholding structures; straight forward debt free collaborative equity. We have stuck to our values as we don’t want to be corrupted as per the original Peer to Peer companies that have now been swallowed up by by the wolves of wall street.

Global Peer to Peer trading via the blockchain is here and it’s growing faster than the adoption of the internet. To operate on the blockchain you need a digital currency, so I created BiPS.

#BiPS Digital Currency — 500 million units of value mined in Alderley Edge November 11 2018–10 Years to the day since Bitcoin was first mined. Global Peer to Peer using BiPS as the full reserve digital currency is live.

If you asked me if I had any political bias I would have to say no, the way the country has been let down by the politicians is an absolute constitutional psunami — and I would say I don’t support any party at this moment in time.

What I do believe in is equality, freedom and I’m not ashamed to say; capitalism. The world needs capitalists; it just does, as this moves the world forward through entrepreneurial invention and creativity and the pioneers involved should be rightly rewarded with their riches.

The financial control and profiteering is centralised. The ability for central banks and governments to print money from thin air through financial engineering, has fuelled the financial world we have lived in since the gold full reserve economy ceased to exist in 1971. It’s all gone wrong in my opinion since then. Many great economists believe a move towards 100% full reserve banking would deliver a better outcome for the global economy.

Perhaps the most influential approach to monetary reform was the 100%- money proposal put forward by Irving Fisher (1935) also known as the plan for 100%-banking. It was called the Chicago plan after a group of Chicago economists, among them Henry Simons and later Milton Friedman (Simons 1948, Friedman 1948, 1959, 1969b, Hart 1935).

The 100%-banking proposal continues to be seen as a possible answer to the Creating New Money problem, and has been the only reform approach respected inside the ivory towers of academia. The plan wanted the banks to be forced to hold a cash reserve of 100% matching every sight and savings deposit. These deposits, being non-cash, would be backed by cash holdings of the same amount. In this way deposits would become again the true and safe cash deposits they were thought to have formerly been.

The question may even arise whether, as Goodhart argues in the context of banking safety (1989: 181ff), “it would be perfectly possible (and generally safer) for transactions services to be provided by an altogether different set of financial intermediaries”.

With the rapid Blockchain and Distributed Ledger Technology advancements, we now have the opportunity to help develop an alternative to the current fractional reserve economy. The Global Peer to Peer economy, with the transfer of value being executed over the Blockchain using an Asset Backed Full Reserve Digital Currency — Welcome to #BiPS

http://www.jamesrobertson.com/book/creatingnewmoney.pdf

https://en.wikipedia.org/wiki/MPeso

https://en.wikipedia.org/wiki/Full-reserve_banking

https://bitcoin.org/bitcoin.pdf

https://en.wikipedia.org/wiki/Government_debt#/media/File:Government_debt_gdp.png